A February 2022 Share Market and Investment Update

The share market decline in January 2022 has brought up concerns about inflation, tighter financial conditions and the economic impact of the new Omicron COVID-19 variant – especially for investors.

Some investors are alarmed by predictions of a market crash by the usual loud voices, consisting of doomsayers and exaggerated headlines.

It’s easy to be reactive to headlines. But it’s important to avoid making impulsive decisions that could have negative impacts on your financial future.

Markets are said to “climb a wall of worry” and history shows that investors who stay the course are more likely to achieve their long-term goals.

Shares have started 2022 on a dismal note, with many markets around the globe registering a ‘correction’, being declines of between 10% – 20%.

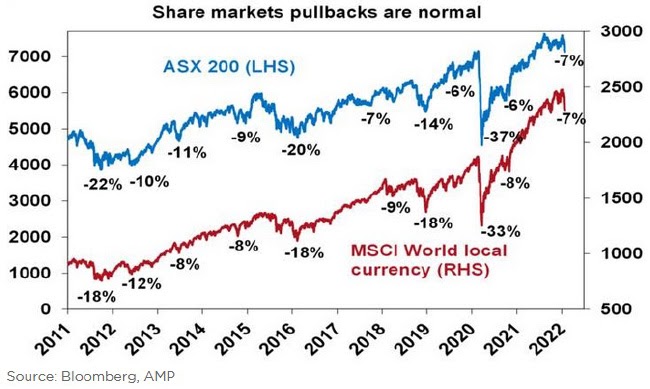

However, share market pullbacks are normal – and even expected.

“Fluctuations are a natural part of the share market.“

While it is not unusual for the share market to move from a record high into correction mode, the media has given a great deal of exposure to the latter, causing unnecessary alarm for some investors.

In the chart above, it can be seen that share markets regularly experience significant sell-offs. The drivers of those pullbacks are diverse and often centre around a combination of rising valuations in the presence of some external risk factor, which could be political, economic, or a “black swan” event (such as a pandemic).

Since the Global Financial Crisis, markets have successfully navigated the European Debt Crisis, a China slowdown, Fed policy tightening and the worst of Covid-19.

While it is too early to know if the recent correction in shares will lead to a capitulation and a bear market (losses of 20% or more), the upcoming interim reporting season will be of heightened importance.

Investors will focus not only on company operating performance, but also on the outlook comments by management. If expectations are missed, it is likely that some stocks will be heavily marked down. Given that this is often an overreaction, it may turn into a buying opportunity for the patient investor.

Which investor do you want to be?

One of the most important things we can educate our clients on is:

- to not be distracted by short-termism

- to avoid exaggerated media noise, and

- to avoid listening to friends about what they should be doing with their investments in the short term and instead, follow professional advice that aligns with your values and goals.

For the time being, economies are on relatively stable footing, with falling unemployment, rising capital investment, excess savings ready to be deployed and businesses keen to get back to some semblance of normal.

As usual, we at Hyland Financial Planning will keep a close eye on events as these unfold.

You can have peace of mind knowing our financial planners and investment advisers are consistently monitoring market performance to ensure our clients are always well-positioned to receive optimal investment results.

If you have any questions or want to talk about investment strategies with one of our financial planners, please reach out. Our door is always open.